Source: China Petrochemical News | Date: 2024-07-10 08:06

Introduction:

In light of the goals of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060, the domestic low-carbon industry is growing rapidly, impacting the downstream demand for the oil and petrochemical industry. With the market expansion of new energy vehicles (NEVs), domestic demand for refined oil has been suppressed. According to estimates, the demand for diesel in China has already peaked and entered a decline, and gasoline demand is expected to peak around 2025. Overall demand for petroleum products may peak in the early stages of the “15th Five-Year Plan.” Without new growth drivers, China’s oil demand could begin to decline from the start of the “16th Five-Year Plan.”

In this context, transformation within the refining and petrochemical industry is imperative. The industry’s transformation can be divided into two broad strategies: “oil-to-chemicals” and “oil-to-specialties.” With the rapid expansion of chemical production capacity, profitability in both domestic and international markets is facing short-term challenges. Amid the “oil-to-chemicals” challenge, the “oil-to-specialties” strategy is gaining more attention. This strategy refers to increasing the production share of specialty products directly from crude oil processing, such as lubricating oil base oils, white oils, sulfur, asphalt, and petroleum coke. Among these products, specialty oils are priced relatively high and can supplement profitability for petrochemical enterprises.

This article analyzes the demand trends for four key categories of domestic specialty oil products—lubricants, rubber plasticizers, white oils, and light white oils (excluding fuel oil)—from a market development perspective. It clarifies the role of specialty oils in achieving the “dual carbon” goals and suggests directions for refining enterprises to further develop their specialty oil businesses.

Long-Term Stability in National Specialty Oil Demand:

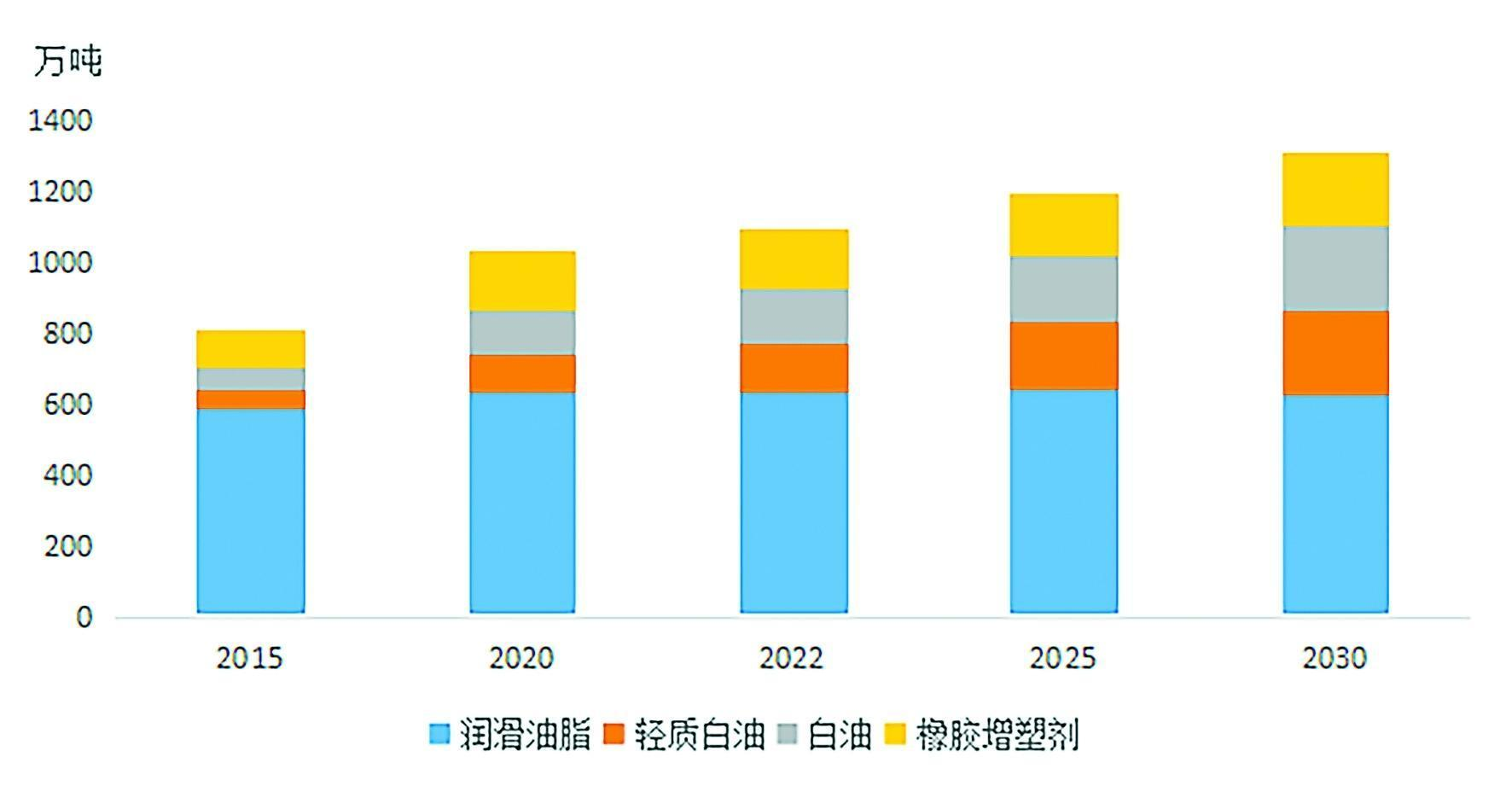

2015~2030China’s specialty oil demand growth

The continuous growth of the specialty oil market reflects its indispensable role in modern industry and high-tech fields. According to the national economic industry classification, the application of specialty oils spans over ten major industry categories and involves nearly a hundred niche application areas, demonstrating its wide applicability. However, the performance requirements for specialty oils vary across different fields, leading to diverse and customized demands in the market. This poses significant challenges for upstream suppliers, who must have strong R&D capabilities and flexible production mechanisms to meet the specific technical standards and quantity needs.

There are three main reasons why global petrochemical companies are actively developing specialty oil products:

1.High economic value: Some specialty oil products are highly profitable, with prices reaching several million RMB per ton, making them an important source of economic benefits for petrochemical companies.

2.Strategic significance: Many specialty oil products are used in key high-tech and strategic industries, such as new energy, new materials, optical communications, biopharmaceuticals, and aerospace. These products often play an irreplaceable role in critical technologies and are of great importance to national security.

3.Market stability: Given the wide range of applications, the overall demand for specialty oils is less affected by short-term industrial policy fluctuations, allowing it to maintain stable growth over the medium and long term.

Notably, the tax policy adjustments introduced in 2023 have further clarified the distinction between specialty oils and refined oils, correcting previous market disruptions and promoting healthy industry development. Since 2015, domestic demand for specialty oils has grown from 8.1 million tons to 11.3 million tons in 2023, with an average annual growth rate of 4.4%. It is expected that by 2030, demand will increase to 13.13 million tons, a 19.7% increase compared to 2022.

The future growth of the specialty oil industry will be driven not only by the development of the national economy but also by the continued demand from high-tech industries, further enhancing its significance in the global market.

Lubricants and Greases: New Demands and Opportunities from Emerging Industries

In terms of raw materials, China’s “13th Five-Year Plan” period (2016-2020) marked a critical phase for the quality upgrade of domestic lubricant base oils. Between 2018 and 2020, the country added over 4.7 million tons/year of base oil production capacity, with more than 70% of it being Group II base oils. By 2023, total production capacity had exceeded 14 million tons/year. As production rapidly expands, Group I base oils are quickly phasing out, with Group II base oils dominating the market. Along with this capacity expansion, domestic products are increasingly replacing imports, with the net import of base oils in 2023 down by 1 million tons compared to the annual average from 2015 to 2020. Additionally, the domestic production of Group III (+) and PAO (poly-alpha-olefin) synthetic base oils is accelerating, especially Group III (+), with several refineries already in production or planning to do so. These high-end base oils will continue to target premium applications in the future. With the accelerated localization of high-end additives, the net import of additives also declined significantly in 2023.

Regarding products, during the “14th Five-Year Plan” period (2021-2025), economic growth is slowing, environmental regulations are tightening, and high-quality development in industrial sectors is leading to stricter quality requirements for lubricants and greases. As a result, oil change intervals are extending, and overall demand for lubricants has reached a plateau. It is expected that the domestic market scale will remain stable at around 6.2 to 6.5 million tons/year during both the “14th Five-Year Plan” and “15th Five-Year Plan” periods.

By demand structure, lubricant and grease consumption can be divided into three categories: industrial lubricants, transportation lubricants, and greases. Grease demand remains relatively stable, at around 400,000 tons per year, with future market demand mainly influenced by industrial and transportation lubricants. In terms of industrial lubricants, the slowing economy will limit growth in some major sectors, and future demand is expected to stabilize. However, with the continuous increase in automation and the widespread adoption of smart factories and robots, there is potential for further growth in industrial lubricant demand.

For transportation lubricants, the development of new energy vehicles (NEVs) is a key factor impacting future demand. Under the impetus of China’s dual-carbon goals, NEVs continue to grow rapidly, with a market penetration rate of 31.6% in 2023. The automotive industry is transitioning from traditional engine-driven vehicles to hybrid electric vehicles (HEVs), battery electric vehicles (BEVs), and fuel cell vehicles (FCVs). Currently, BEVs and electric commercial vehicles are relatively mature technologies and are expected to dominate in the future, while hybrid vehicles, with their advantages of convenient refueling and energy efficiency, will become a major technical route in the commercial vehicle sector. It is estimated that between 2022 and 2030, the proportion of hybrid and electric vehicles in annual car sales will rise rapidly, with annual sales of hybrids and BEVs expected to exceed 10 million and 13 million units respectively by 2030, accounting for 24.9% and 36.3% of total sales. The combined market share of NEVs will exceed 61.2%. Since BEVs do not use engine oil, transportation lubricant demand is expected to face downward pressure after 2030.

However, the rise of NEVs also brings new opportunities. Compared to traditional vehicles, NEVs have different lubrication requirements, and their electric drive systems have introduced new lubrication needs. Moreover, the rapid growth of China’s domestic NEV brands presents market opportunities for domestic lubricant brands. In 2023, domestic passenger car sales reached 14.6 million units, with a market share of 56%, while domestic NEVs achieved a market share of 77%. In the traditional automotive sector, domestic lubricant brands have had relatively low market share due to the dominance of international brands, but the rapid development of domestic NEVs provides new opportunities for market expansion.

In addition, demand for lubricants and greases in emerging industries is gradually expanding. With the development of wind power, photovoltaics, energy storage, semiconductors, and other emerging industries, the demand for high-end lubricants and greases is expected to grow rapidly.

Rubber Plasticizers: Steady Market Expansion

Rubber plasticizers are essential additives used in rubber production to improve properties like elasticity, flexibility, processability, and blendability. They are categorized into three types based on their molecular structure: aromatic, naphthenic, and paraffinic plasticizers. The type, specifications, and fill ratio of plasticizers vary depending on the type of rubber used and the application field. Since there is no uniform standard for paraffinic rubber plasticizers, their consumption is often counted based on white oil specifications, with domestic demand for white oil used in rubber production exceeding 300,000 tons in 2023.

Demand for rubber plasticizers is closely tied to the rubber industry. With the industry’s development in recent years, domestic consumption of rubber plasticizers (aromatic and naphthenic) has increased from 1.06 million tons in 2015 to 1.73 million tons in 2023, with a total production capacity exceeding 4.3 million tons/year. Based on predictions of future rubber production growth in various sectors and the corresponding fill ratios of plasticizers, China’s demand for rubber plasticizers is expected to exceed 2.1 million tons by 2030, with the market steadily expanding.

At the same time, rubber plasticizer products are significantly influenced by downstream regulations, making it crucial for refining and chemical enterprises to closely monitor new policies and requirements in the rubber industry. For example, developed countries and regions like the EU and the U.S. have imposed restrictions on carcinogenic polycyclic aromatic hydrocarbons (PAHs). In response, China has also introduced relevant standards, leading to a surge in production of environmentally friendly aromatic plasticizers.

White Oil: Transitioning to High-end and High Viscosity

Low-to-medium viscosity white oils, often used illegally as a blending agent in fuel sales, have garnered industry attention. According to a 2023 policy announcement from the Ministry of Finance and the State Administration of Taxation, certain industrial white oils (grades 5, 7, 10, 15, 22, 32, 46) will be taxed as solvent oils, effectively ending their misuse as a source of illegal profit.

Statistics show that in 2023, the domestic demand for compliant white oil exceeded 1.5 million tons, with an average annual growth rate of over 12%. Low-to-medium viscosity industrial white oils, which are primarily used in low-value applications such as fiber lubricants and rubber plasticizers, accounted for about 60% of total white oil consumption. With the price increase due to the tax, the profitability of low-viscosity white oils will face further challenges. Moving forward, the white oil industry should focus on high-end, high-viscosity products. Cosmetics-grade, food-grade, and pharmaceutical-grade white oils, as well as some high-viscosity products, have relatively higher production thresholds, and some applications are linked to national strategic emerging industries, ensuring faster demand growth. It is projected that by 2030, domestic white oil demand will grow to over 2.4 million tons, with an average annual growth rate of over 6% from 2022 to 2030.

Light White Oils: Gradually Replacing Ordinary Solvent Oils Due to Environmental Benefits

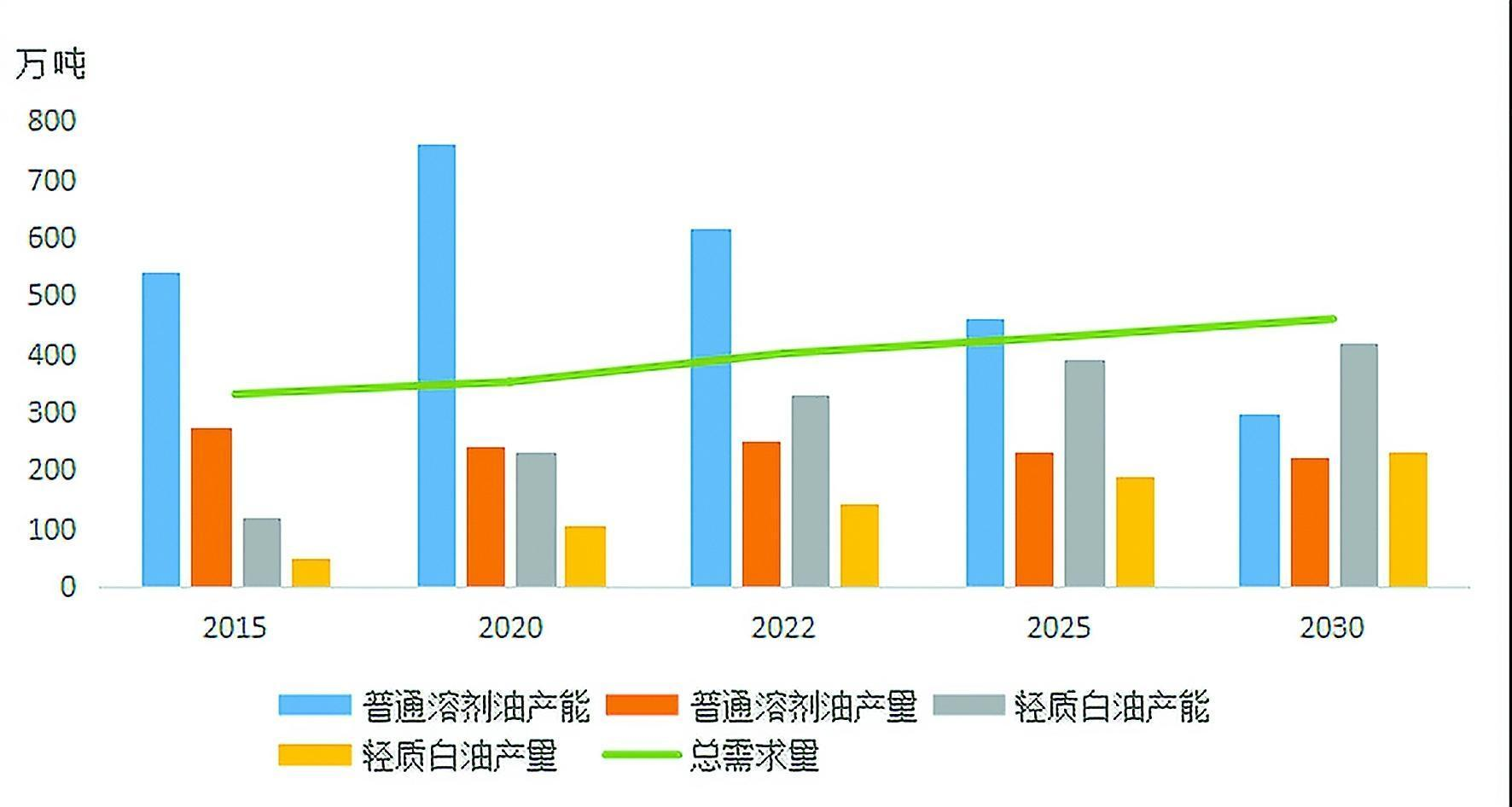

Supply and Demand Forecast for Solvent Oil Products in China (2015–2030)

Overall, solvent oil products are characterized by their wide variety, broad application fields, and relatively low total demand. They are widely used in areas such as edible oil processing, pesticides, fragrances, pharmaceuticals, cosmetics, insecticides, rubber, adhesives, and metalworking. According to incomplete statistics, there are currently more than 200 types of solvent oils available in the Chinese market. Due to factors such as market development, national standard upgrades, and inconsistencies between imported and domestic solvent oil grades, the variety of solvent oil grades can seem overwhelming. However, from an environmental perspective, solvent oil products can be broadly categorized into regular solvent oils and light white oils with lower aromatic content.

Light white oil, also known as de-aromatized mixed solvent oil or D-series solvent oil, can replace regular solvent oil in most applications and better aligns with the green, environmentally friendly, and low-carbon development trend. With increasingly stringent environmental regulations in China, safe and clean light white oil is developing rapidly. As of 2023, China’s light white oil production capacity reached over 3.3 million tons per year, 2.76 times that of 2015. Annual production exceeded 1.5 million tons, 2.85 times that of 2015. With the introduction of China’s 2023 consumption tax policy, the cost of light white oil has risen, and future capacity expansion is expected to slow, focusing on gradually replacing regular solvent oil in the existing market with more environmentally friendly products.

From 2015 to 2023, the overall supply of solvent oil in China grew steadily, with total capacity increasing from 6.6 million tons per year to over 9.5 million tons per year, reflecting an average annual growth rate of about 5%. In contrast, total demand for solvent oil products grew more slowly, and it is expected that the oversupply of solvent oils will continue for some time. At the same time, as the regular solvent oil market undergoes consolidation and restructuring, with increasingly strict environmental policies and shrinking profit margins reducing refineries’ production enthusiasm, both the capacity and output of regular solvent oil are in decline. It is expected that smaller facilities producing less than 100,000 tons per year will accelerate their exit from the market. Based on the development of solvent oil demand and trends toward environmentally friendly alternatives, light white oil production is forecast to exceed 2.2 million tons by 2030, with an average annual growth rate of about 6% from 2022. This could ease competitive pressure in the overall solvent oil market.

Comment: Differentiated Development is Key to the Growth of Specialty Oil Markets

Driven by China’s carbon peak and carbon neutrality goals, specialty oils will continue to play a crucial role in both the economy and society. From a market perspective, specialty oil products are widely used across traditional industries and strategic emerging sectors. Not only is future demand expected to maintain stable growth, but specialty oils also ensure the completeness of China’s industrial system and are key to the country’s independent economic development. Furthermore, some specialty oil products are highly profitable, and due to their involvement in diverse downstream sectors, overall demand is relatively resilient to economic downturns and risks. In the future, specialty oils could become a significant profit driver and backup force for petrochemical companies.

For refining companies, it is recommended to consider the long-term development of specialty oils from three aspects:

1.Strategic Layout Adjustment: Given that specialty oil demand is highly differentiated and customized, and the market scale is much smaller compared to bulk refined products, companies should avoid using the same approach as they would for bulk products. Instead of blindly pursuing scale, production planning should be market-oriented and raw material-based, with a focus on differentiated development. Not all companies need to scale up specialty oil production; they should determine their development focus based on their niche market and raw material supply.

2.Strengthening R&D: Companies should focus on developing new high-end products that address critical bottlenecks while also upgrading existing products to meet evolving downstream requirements. Environmental transformation is another important trend, with research focused on energy savings, carbon reduction, and desulfurization.

3.Improving Marketing Models: Depending on the characteristics of the product market, companies should select appropriate marketing strategies tailored to their specific products.

Post time: Nov-22-2024